Retain Greater Purchase Power

Why is the 1031 Exchange popular with real estate investors? Because it lets taxpayers defer their taxes and keep those dollars to reinvest into new property. Let’s look at an example.

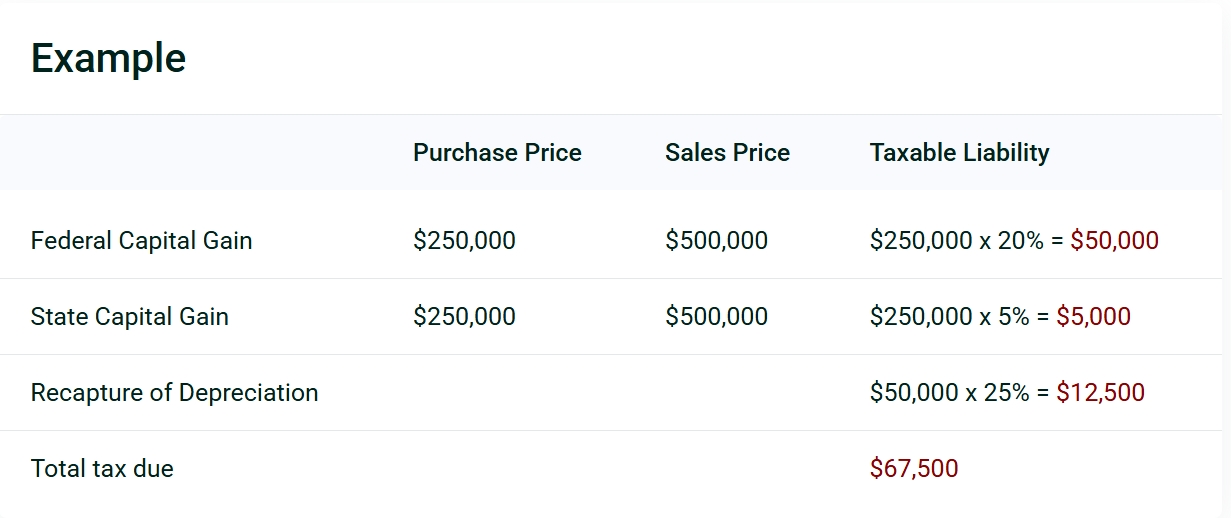

Let’s assume that this taxpayer sells property for $500,000 is in the 20% federal capital gains tax bracket. They also live in a state that has a 5% state tax. Lastly, they have taken $50,000 in depreciation on the real property during their ownership.

This taxpayer has a $67,500 tax liability upon the sale of their property without the 1031 Exchange. By entering into the 1031 Exchange before the closing of their Relinquished Property, this taxpayer will defer their taxes allowing them to “keep” these tax dollars, giving them the opportunity to use those funds to reinvest into new Replacement Property. They will have the chance to make money on the dollars that they should have paid in taxes.

The 1031 Exchange allows investors to redeploy their funds into new real estate endeavors, avoid the “lock-in” effect by being stuck in their current property, and still create new jobs, new opportunities, and contribute to federal, state, and local tax revenue.

For more information, please reach out to your tax professional for specific questions or contact the specialists here at Security 1st Exchange for assistance.